Cap rates explained

Cap rates, short for capitalization rates, are a fundamental metric used in the commercial real estate industry to determine the value of income-producing properties. It serves as a way to evaluate the return on investment (ROI) potential of a commercial property.

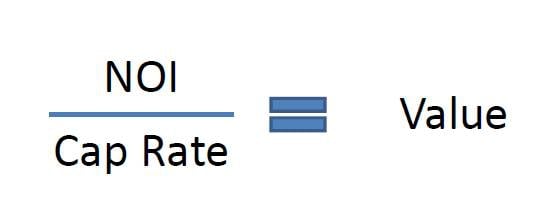

The cap rate is expressed as a percentage and is calculated by dividing the property’s net operating income (NOI) by its purchase price or current market value. The formula for calculating the cap rate is as follows:

Cap Rate = Net Operating Income / Purchase Price or Market Value

Net Operating Income (NOI) refers to the annual income generated by a property after subtracting operating expenses but before accounting for financing costs, income taxes, and depreciation. It typically includes rental income, parking fees, and other sources of revenue directly related to the property’s operation.

The cap rate provides a measure of the property’s overall investment yield. A higher cap rate indicates a higher potential return on investment, while a lower cap rate implies a lower potential return. It is important to note that cap rates vary across different markets and property types and are influenced by factors such as location, property condition, lease terms, and prevailing market conditions.

Investors often use cap rates as a benchmark to compare different investment opportunities and assess their relative attractiveness. For example, let’s say there are two office buildings available for purchase, each with an annual NOI of $500,000. Building A is priced at $5 million, while Building B is priced at $7 million. The cap rates for the two properties would be as follows:

Example:

Cap Rate for Building A = $500,000 / $5,000,000 = 0.10 or 10%

Cap Rate for Building B = $500,000 / $7,000,000 = 0.071 or 7.1%

In this scenario, Building A has a higher cap rate (10%) compared to Building B (7.1%). This suggests that Building A may offer a potentially higher return on investment compared to Building B, assuming all other factors are equal.

It’s important to note that cap rates alone do not capture the entire picture of an investment. They should be used in conjunction with other financial and qualitative analyses to make informed investment decisions. Additionally, cap rates can fluctuate over time as market conditions change, impacting property valuations.

Overall, cap rates are a widely used tool in commercial real estate to evaluate the income potential and relative value of investment properties. They provide investors with a quick snapshot of a property’s profitability and help guide investment decisions in the commercial real estate market.

We hope this helps you make smarter investments!If you’re ready to search for a revenue generating property to purchase, you can start here! You can also find more properties on our Crexi pages.

Sign up for the VIP list here to get investment properties before they hit the market!