Maximizing Tax Benefits in Commercial Real Estate

Introduction:

When it comes to commercial real estate investments, savvy investors and property owners are constantly exploring strategies to optimize their returns. One often-overlooked technique that can significantly impact the bottom line is cost segregation. In this blog post, we will delve into the concept of cost segregation, its tax benefits, and how it can unlock substantial savings for commercial property owners. Let’s uncover the potential of cost segregation and discover how it can work wonders for your real estate portfolio.

What is Cost Segregation?

Cost segregation is a strategic tax planning tool that allows commercial property owners to accelerate depreciation deductions by identifying and classifying different components of a property for tax purposes. Instead of depreciating the entire property over a long period, cost segregation breaks down the assets into shorter depreciation periods, resulting in substantial tax savings.

How Does Cost Segregation Work?

Cost segregation involves a detailed analysis of a property’s assets to determine their proper classification for tax purposes. By partnering with qualified professionals such as engineers, appraisers, and tax experts, commercial property owners can conduct a comprehensive study that identifies various components eligible for accelerated depreciation.

During the study, experts analyze the property’s structural elements, electrical systems, plumbing, HVAC systems, and other tangible assets. They determine which components can be reclassified as personal property or land improvements, which have shorter depreciation periods compared to the building’s overall structure. This classification allows property owners to claim accelerated depreciation deductions and maximize their tax benefits.

Tax Benefits of Cost Segregation:

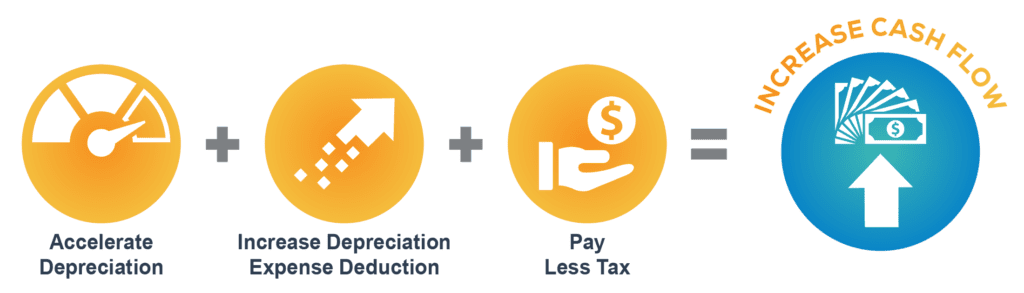

Increased Cash Flow:

By accelerating depreciation, cost segregation enables property owners to reduce their taxable income and generate significant cash flow in the early years of ownership. This additional cash flow can be reinvested or used to fund property improvements, expansion plans, or other investment opportunities.

Lower Tax Liability:

The shortened depreciation periods resulting from cost segregation allow property owners to claim higher deductions, thereby reducing their overall tax liability. These tax savings can be reinvested into the property, increasing its value and potential returns.

Improved Return on Investment (ROI):

Cost segregation can enhance the ROI of commercial real estate investments. By front-loading depreciation deductions, property owners can recover a larger portion of their investment earlier, leading to improved profitability and overall return on investment.

Mitigation of Tax Consequences from Property Disposition:

Should the property be sold, cost segregation can help minimize the tax consequences. By establishing a clear separation between different assets, property owners can ensure they pay taxes only on the appropriate components, potentially resulting in significant tax savings.

Conclusion:

Maximizing cost segregation tax benefits in commercial real estate is a powerful tax planning strategy that offers substantial benefits to commercial real estate owners. By properly identifying and classifying assets, property owners can accelerate depreciation, increase cash flow, reduce tax liability, and improve their return on investment. It is crucial to consult with qualified professionals experienced in cost segregation studies to ensure compliance with tax laws and to maximize the potential tax benefits. Incorporating cost segregation into your commercial real estate strategy can unlock untapped opportunities and position your portfolio for long-term success. Take advantage of this valuable tool and reap the rewards it offers in today’s competitive real estate market.

Get on the list for investment properties BEFORE they hit the market!

– Keith Hill

keith@billpoolerealty.com